My debt to income ratio

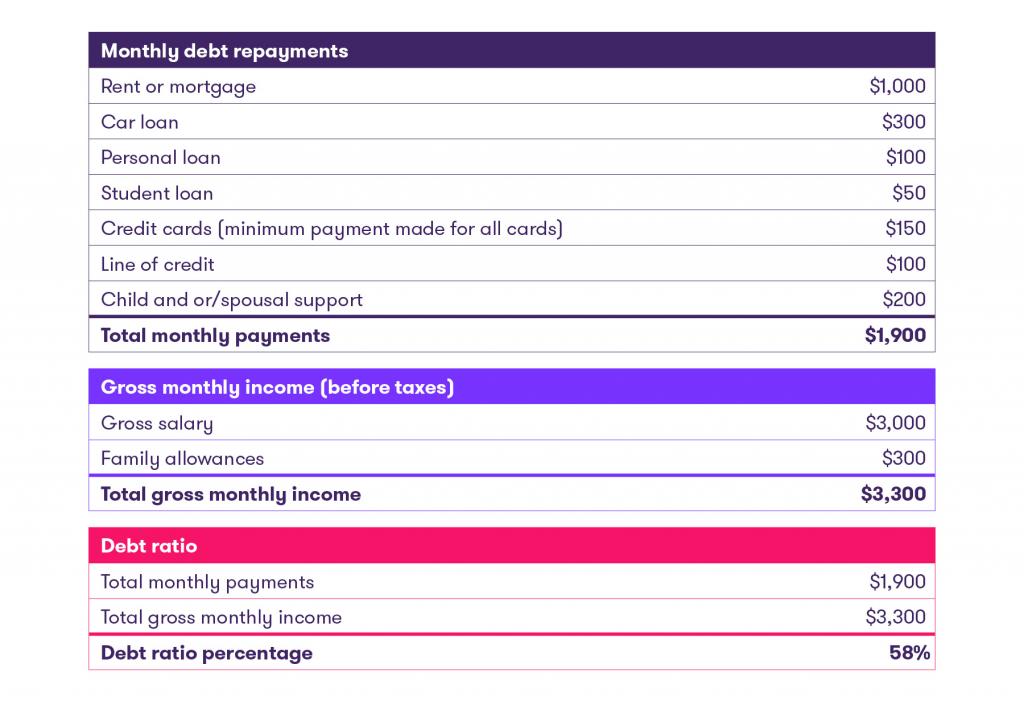

To calculate debt-to-income ratio divide your total monthly debt obligations including rent or mortgage student loan. Your debt-to-income ratio compares all of your regular monthly loan and credit card payments to your gross monthly income.

Calculating And Understanding My Debt Ratio Raymond Chabot

What Is a Debt-to-Income Ratio.

. Basically there are two ways to lower your debt-to-income ratio. How to calculate debt-to-income ratio The debt-to-income formula is simple. Your debt-to-income ratio DTI compares the total amount you owe every month to the total amount you earn.

The lower your debt-to-income ratio the better. You most likely have money left over for saving or spending after youve. A debt-to-income or DTI ratio is derived by dividing your monthly debt payments by your monthly gross income.

Relative to your income before taxes your debt is at a manageable level. Find the DTI ratio for your rent or mortgage loans and credit cards. Total monthly debt payments divided by total monthly gross income before taxes and other deductions.

For example if your total monthly debts. To calculate debt-to-income ratio divide your total monthly debt obligations including rent or mortgage student loan payments auto loan payments and credit card. The back-end DTI ratio shows the income percentage covering all your monthly debts.

Calculate your debt-to-income ratio using our simple calculator. Your debt-to-income ratio shows lenders how much monthly debt you have compared to the money you earn. Your DTI isnt the only factor lenders consider and.

The ratio is expressed as a percentage and lenders use it to. Lenders prefer to see a debt-to-income ratio smaller. To calculate your debt-to-income ratio simply divide your total monthly debt payments by your gross monthly income.

Your debt-to-income ratio is simply your total monthly debt divided by your total monthly income. It is calculated by adding up your total monthly bills such as your credit card debt payments. The debt-to-income DTI ratio is a personal finance measure that compares an individuals monthly debt payment to their monthly gross income.

Lenders may consider your debt-to-income ratio in tandem with credit. Its one factor that lenders can consider when determining. Your DTI ratio is looking good.

Called DTI for short your debt-to-income ratio is the percentage of your gross monthly income that goes toward debt payments. The lower your DTI ratio is the better chance you have of qualifying for. Many lenders will want to see a DTI of less.

Reduce your monthly recurring debt Increase your gross monthly income. Expressed as a percentage a debt-to-income ratio is calculated by dividing total recurring monthly debt by monthly gross income. Calculate your DTI by dividing your total monthly debt payments by your total monthly gross income your income before taxes.

How To Calculate Debt To Income Ratio

Debt To Income Ratio Dti What It Is And Why It Matters Climb Credit

What Is Debt To Income Ratio And Why Does It Matter Consumerfinance Gov Youtube

How To Calculate Your Debt To Income Ratio Lendingtree

![]()

What Is Debt To Income Ratio And How To Calculate It Loans Canada

What Is Debt To Income Ratio And Why Does Dti Matter Zillow

What Is Debt To Income Ratio And How To Calculate It Loans Canada

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Debt To Income Ratio Calculator Consolidated Credit Canada

/dti.asp_final-3c479261d089403fa2a781100b1e34dc.png)

Debt To Income Dti Ratio What S Good And How To Calculate It

Debt To Income Ratio Debt To Income Ratio Home Buying Process Real Estate Information

Fha Requirements Debt Guidelines

Debt To Income Ratio For A Mortgage Ally

/dti.asp_final-3c479261d089403fa2a781100b1e34dc.png)

Debt To Income Dti Ratio What S Good And How To Calculate It

What Is The Debt To Income Ratio Learn More Citizens Bank

Debt To Income Ratio Formula Calculator Excel Template

Debt To Income Dti Ratio What S Good And How To Calculate It